Factoring 101

What Is Factoring?

Factoring is the purchase of accounts receivable at a discount. That is, a factor pays a client immediate cash for the client’s invoices for which payment is due in the future.

Factoring is not a loan with interest due, but the purchase of an asset at a discounted rate from the asset's face value. Therefore, factoring clients are not paying an interest rate as they would for a bank loan, but a discount, as they would if they were giving terms to a customer for early payment.

Factoring is not a loan with interest due, but the purchase of an asset at a discounted rate from the asset's face value. Therefore, factoring clients are not paying an interest rate as they would for a bank loan, but a discount, as they would if they were giving terms to a customer for early payment.

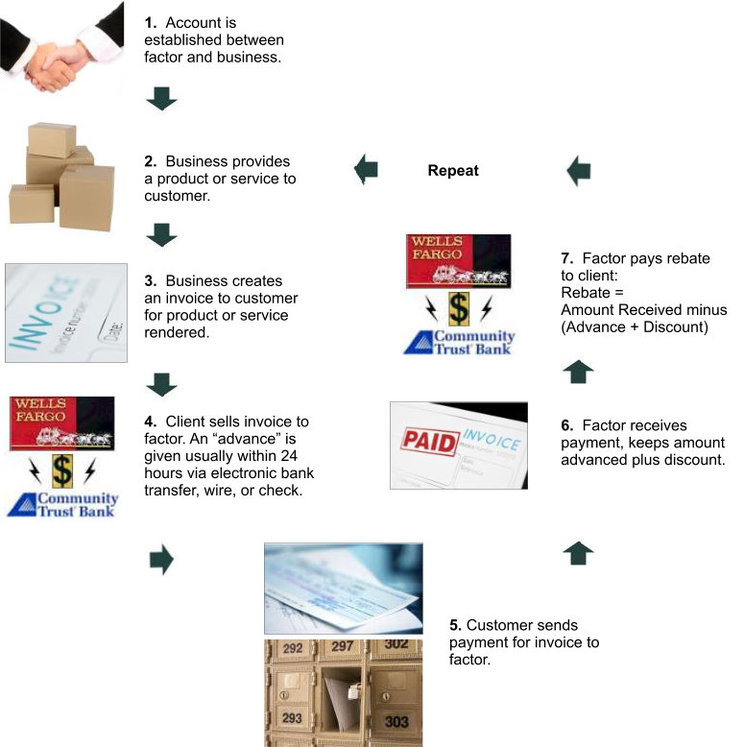

How Does This Work?

Here is a diagram of how factoring typically works.